Artificial intelligence is bringing transformative changes to the insurance industry across key areas like underwriting, claims, fraud detection, risk management, customer service, and more.

AI enables insurers to operate faster, more intelligently, and on a larger scale than ever before.

Some major ways AI is impacting insurance include:

While still early in adoption, innovative insurers are already using AI to transform legacy processes and leapfrog competitors. AI-driven insurance delivers faster, smarter, and more customized experiences while optimizing risks and costs. This is revolutionizing the competitive landscape across P&C, life, and health insurance segments.

At its core, AI allows insurers to shift from reactive, backward-looking statistical approaches to proactive, predictive data modeling.

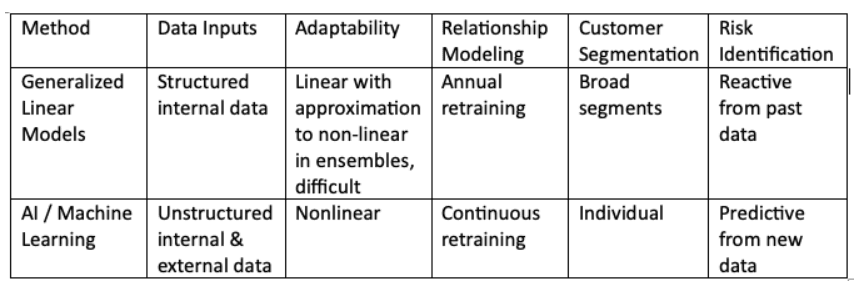

For over a century, actuaries have relied on historical data and generalized linear models to assess risks and set premiums. But these methods have key limitations:

In contrast, machine learning and deep learning can synthesize wider, unstructured datasets covering customer profiles, behaviors, external risks, and more. Advanced algorithms model highly complex variable interactions and relationships missed by traditional models. AI models also update continuously by retraining on new data. And AI enables customer-level personalization versus broad segments.

Below is a comparison between traditional generalized linear models and modern AI techniques:

While actuaries still provide invaluable expertise, leading insurers are augmenting traditional actuarial science with modern AI to unlock richer insights across the insurance value chain. Combining actuarial knowledge with AI may enable the biggest performance leap for risk analytics and underwriting in decades.

But an over reliance on historical actuarial approaches in isolation, while complying with a rigid regulatory frameworks that does not reward (in fact, does not understand) innovation will make it difficult for insuretechs to keep pace with the rapid advances in tech that could give them and advantage.

This is even more difficult when they need to satisfy regulatory environments that favor "legacy methods", thus, artificially slowing down their growth.

One of the most exciting emerging AI applications for insurance risk analytics is generative modeling. Generative algorithms can synthetically generate new, realistic data samples after learning patterns from real-world data.

For insurers, generative models open exciting new possibilities to enhance risk management:

Overall, generative modeling unlocks a paradigm shift for insurers and enables a proactive risk management instead of a reactive one. Scenario modeling is limited only by computational power, not constrained by finite historical data. As generative AI matures, leading insurers will embrace it to make risk management predictive, nuanced, and forward-looking as never before.

First movers leveraging generative AI for insurance risk modeling will gain a substantial competitive advantage. Those slow to adopt will lag in risk analytics capabilities.

Generative AI promises to be a true game changer for the insurance industry in managing risks and designing sustainable, innovative products.

Historically, actuaries have dominated insurance risk modeling and underwriting, but data science teams are gaining influence as insurers embrace AI. This is creating natural friction between traditional actuarial culture and newer data-driven mindsets, specially in environments where one culture was already predominant.

Actuaries pride themselves on mathematical and theoretical rigor, statistical precision, and adherence to regulatory principles. Data scientists and quants tend to value exploration, flexibility, and openness to new techniques like machine learning. Actuaries optimize to avoid worst-case scenarios in a purely backwards looking sense. Data scientists accept some risk in pursuing predictive insights and establish risk-rewards tradeoffs.

These differences can lead to unhealthy turf wars within insurance firms. However, the most successful insurers will bridge their actuarial and data science capabilities. A collaborative, integrated approach is ideal.

In my view, actuaries should maintain leadership over core pricing, reserving, and capital modeling to leverage their risk management expertise. But Senior data scientists and quants should have free rein to innovate, enhancing predictive analytics, and deliver competitive advantages, not possible with actuarial science.

In a legacy industry and w/o much capital to grow, either you innovate or you die. Effective integration comes down to communication, mutual understanding, and true leadership.

Above all, insurers need senior executives in finance, insurance, risk management, computer science and actuarial analysis, who can synthesize the strengths of those disciplines in a forward looking approach.

I believe that with a patient leadership, insurers can reap the benefits of traditional actuarial science and modern data analytics working in harmony. The firms that can successfully bring their actuaries and data scientists together working under the tutelage of the most qualified professional(s) with relevant experience in some or all of the fields above will have an advantage in the age of AI.

But cultural obstacles require enlightened leadership with the know-how to visualize and understand the full potential. It also requires patience, and maybe capital beyond what is "normal" for a typical startup even at levels of an average Series B or beyond.

A tech-driven managing general agent (MGA) can leverage ML and big data to capitalize on miss priced policies and cherry-pick the best risks, as indeed some of the smart capital out there is doing right now. An MGA is an intermediary that manages insurance programs and assumes underwriting authorities delegated by an insurer.

Using DNNs, the MGA can model complex variable interactions missed by traditional GLMs. The DNN continuously retrain on new data, ensuring risk assessments and pricing keep pace with evolving real-world conditions.

This enables the MGA to precisely segment risk levels and pinpoint optimal premiums for each client. The MGA can identify and capture safety-conscious clients with competitive rates - while avoiding poor risks prone to claims.

In effect, AI unlocks what I call a "slow motion arbitrage" whereby the MGA systematically undercuts rivals for good risks and avoids unfavorable risks, never taking the lion's share of the risk. This drives steady profitability over time as the MGA accumulates lower-risk policies in a disciplined, optimized approach.

The advanced analytics translate into a strategic edge, allowing the MGA to reshape industry dynamics through superior risk selection and pricing optimization. The MGA steadily accumulates quality risks without aggressively growing market share.

An actuarial-based insurer relying on static historical data and pricing models will struggle to match the ML-powered MGA's granular customer segmentation and continuous pricing optimization. Indeed, machine learning is far more than a tactical tool for the new MGAs coming to market. It is an asset that enables the MGA to disrupt the industry through superior risk analytics, disciplined underwriting, and sustained profitability.

It is too early to tell, but there are some recent events that one can use to make inferences about the future.

Two Sigma, known for its data science and hedge fund trading strategies, is entering insurance technology by focusing first on commercial trucking insurance underwriting.

Through its new unit Two Sigma Insurance Quantified, effectively an MGA, the hedge fund aims to leverage its analytical capabilities to improve risk assessment and pricing in commercial trucking insurance. This represents a beachhead into the wider commercial P&C insurance market.

Two Sigma IQ plans to organize trucking fleet data and enrich it with other sources to enable underwriters to make faster underwriting decisions, based on metadata in VIN numbers of trucks, private and public databases, etc. Rather than automating existing workflows, the priority is boosting underwriting insights through data modeling and AI.

With its hedge fund resources, financial quantitative analysis DNA, and proven capability to raise billions of USD in capital w/o the need of opaque VC firms in the middle, Two Sigma can take a patient, analytical approach to innovating in commercial trucking insurance underwriting. The firm's priorities align more with optimizing underwriting outcomes versus digitizing legacy processes.

By concentrating first on trucking insurance, Two Sigma can refine its data-driven approach and predictive modeling capabilities in a focused segment before expanding into larger commercial P&C market. This initial focus demonstrates how Two Sigma is strategically leveraging its strengths in financial quantitative analytics to disrupt a niche insurance area first.

Two Sigma has over 20 years of experience in financial quantitive analysis and modeling to add to its new foray into insurance technology. With $60 billion in AUM, the hedge fund also has tremendous financial backing to support its insurance operations, like some of the pioneers of this area in the past: Lehman Brothers' Lehman Re, Goldman Sachs’s Arrow Re and Credit Suisse Re.

This deep war chest differentiates Two Sigma from many insurtech startups facing potential funding shakeouts for the rest of 2023 and maybe 2024. As some industry experts have noted, some insurtechs may run out of capital or might be acquired at deep discounts as the market consolidates. But Two Sigma's position is to take a long view in developing insurance underwriting capabilities.

Some compare Two Sigma's insurance tech ambitions to Warren Buffet's long-term investments in the insurance industry. With its data science expertise and patient capital, Two Sigma can strategically build out its insurance analytics platform and pursue acquisitions without relying on external funding.

Given its financial prowess, Two Sigma is not just going to dip its toes in the insurtech sector like many others. The firm possesses the capacity to make a profound, long-term commitment necessary to revolutionize data-driven underwriting in a $6 trillion global industry. While some insurtechs may offer flashy yet shallow apps and/or overstate their technical abilities and expertise, Two Sigma brings substantial institutional weight and a tradition of analytical rigor cultivated over two decades.

If Two Sigma's initial venture into the insurance sector is just a beginning, it is evident that the dominant culture will be one of financial quantitative analysis and data science, surpassing the traditional and dominant actuarial mindset.

The dynamics in this sector are set to become highly engaging, evolving into a scenario where gains for a few players are counterbalanced by losses by many others.